Home

/

CRUDE OIL

/

EXCLUSIVE

/

NEWS

/

US oil benchmark goes NEGATIVE for first time after value plunge

US oil benchmark goes NEGATIVE for first time after value plunge

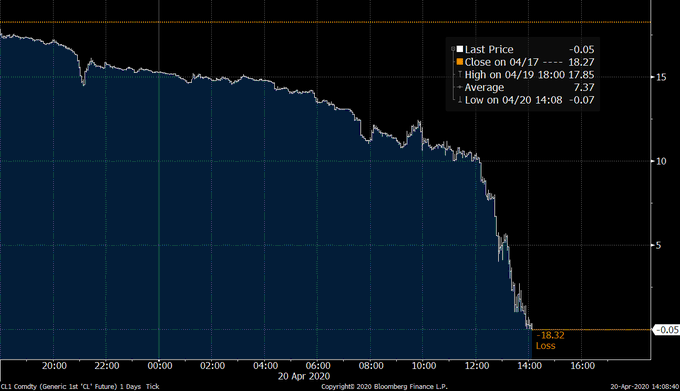

West Texas Intermediate oil costs have gone negative in a record low for the US benchmark as the market proceeds to hole in the midst of the general monetary breakdown.

Disappearing request and an overabundance of supply have consolidated to vigorously affect the US benchmark fuel, with costs dropping from $18.27 to underneath $0 on Monday - down more than 100 percent from the earlier day's nearby and the first run through the oil prospects contract has ever exchanged the negative

The breakdown in oil markets comes in the midst of a summed up financial downturn, with the coronavirus pandemic diving a large portion of the world's economies into a descending winding many accept will be the most profound since the Great Depression of the 1930s.

Worldwide oil stockpiling is at present arriving at its cutoff points, and keeping in mind that OPEC as of late made sure about a 9.7 million barrel for every day cut underway, the US Department of Energy is by and by gauging paying household makers to just leave the oil in the ground so as not to additionally discourage costs.

With May's prospects contracts set to lapse on Tuesday, speculators are scrambling to dump their positions, looking at the effectively glutted market and worried about being left with a valueless item.

As the prospects contracts floated at record lows, oil tankers are apparently moping adrift, unfit to discover spots to store their abundance inland. Interest for the item has dropped an expected 30 percent worldwide in the midst of the coronavirus emergency.

Worldwide oil stockpiling is at present arriving at its cutoff points, and keeping in mind that OPEC as of late made sure about a 9.7 million barrel for every day cut underway, the US Department of Energy is by and by gauging paying household makers to just leave the oil in the ground so as not to additionally discourage costs.

With May's prospects contracts set to lapse on Tuesday, speculators are scrambling to dump their positions, looking at the effectively glutted market and worried about being left with a valueless item.

As the prospects contracts floated at record lows, oil tankers are apparently moping adrift, unfit to discover spots to store their abundance inland. Interest for the item has dropped an expected 30 percent worldwide in the midst of the coronavirus emergency.

US oil benchmark goes NEGATIVE for first time after value plunge

![US oil benchmark goes NEGATIVE for first time after value plunge]() Reviewed by New World Vybes

on

April 20, 2020

Rating: 5

Reviewed by New World Vybes

on

April 20, 2020

Rating: 5

![[PROFILE] CHRISTY ESSIEN-IGBOKWE: The Music Plays, Memory Lingers On eight years after](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgT5UloQN5mm7Tk2mjD2lYZ7D2sYuO8sNi8atAgOY9Q6SwOrrEZLmKjNjLWKzJiL4_Hn7_I7UbNFO9_8vDpN9-k58jIPm2oaBYz9sICkCF4PdxZGmV4OBFp2vy4rcVur0odxYxJgdcEMF1A/s72-c/ibokwe.jpeg)